- Bearish EU meals: German soybean meal exports fell 11% and rapeseed meal 22% y/y (Jul–Nov 2025), signaling weaker crush or demand across key EU buyers.

- Structurally supportive Black Sea values: Russia aims to cut grain’s share in ag exports from 36.9% to 25% by 2030, gradually prioritizing higher-value processed products over bulk grain.

- Neutral for near-term Black Sea flows: Russian inspections of 135,000 tonnes of corn and barley for Iran confirm ongoing Russia–Iran grain corridor activity despite long‑term diversification plans.

German Meal Export Trends

German oilseed meal exports declined sharply in July–November 2025. Soybean meal shipments fell 11% year-on-year to 741,000 tonnes, while rapeseed meal exports dropped 22% to 537,000 tonnes over the same period, highlighting pressure on Europe’s largest crushing hub.

| Product | Period | Export Volume (tonnes) | Y/Y Change |

|---|---|---|---|

| Soybean meal (Germany) | Jul–Nov 2025 | 741,000 | -11% |

| Rapeseed meal (Germany) | Jul–Nov 2025 | 537,000 | -22% |

By destination, the Netherlands remained the leading buyer of German rapeseed meal at around 200,000 tonnes, but this was still 30% below the prior year. Denmark imported 87,600 tonnes (down 2%), regaining the second spot, while flows to Sweden, Finland, and Switzerland all lagged previous volumes.

On the soybean meal side, Czech demand stayed broadly unchanged at 148,300 tonnes. Poland emerged as the key growth outlet, with imports jumping from 10,000 tonnes to 106,000 tonnes year-on-year, partially offsetting weakness elsewhere in the EU.

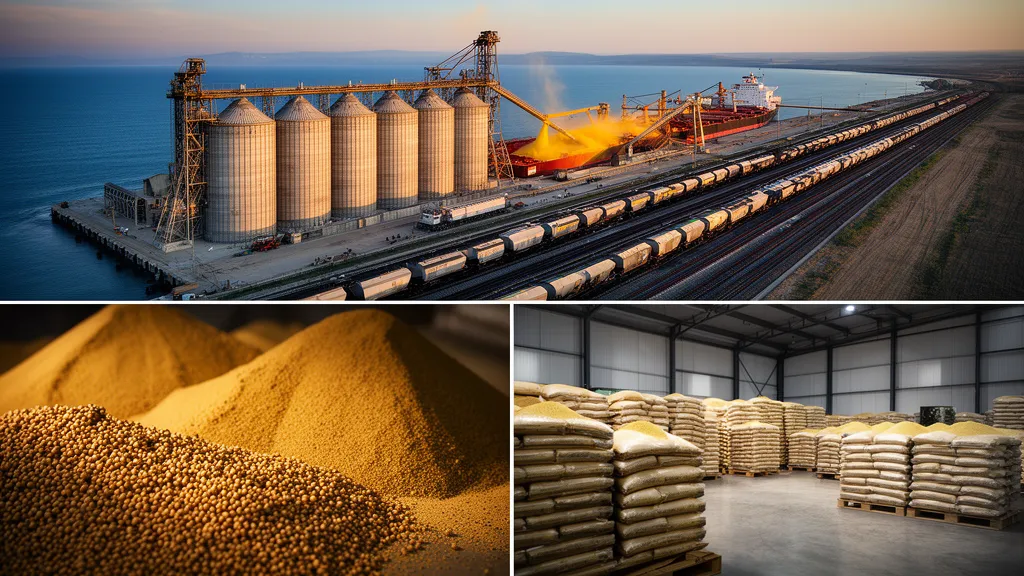

Russia’s Export Strategy Shift

Russia plans a structural shift in its agricultural export mix. Agriculture Minister Oksana Lut outlined a target to reduce grain’s share in total agricultural exports from 36.9% in 2024 to 25% by 2030, prioritizing higher value-added products such as processed foods, flour, and vegetable oils.

| Metric | 2024 | 2025 | 2030 Target |

|---|---|---|---|

| Grain share in ag exports | 36.9% | n/a | 25.0% |

| High value-added product exports | n/a | $19.0 billion | Higher (unspecified) |

| Total food exports | n/a | $41.5 billion | n/a |

| Number of destination countries | n/a | ≈160 | n/a |

High value-added agricultural exports reached $19 billion in 2025, an 8% increase from 2024, while overall food exports were about $41.5 billion. Russia now supplies roughly 160 countries, underscoring its expanded footprint in both bulk and processed products.

Black Sea Grain Logistics and Iran Flows

Operationally, Black Sea grain flows to Iran remain active. In January 2026, Rosselkhoznadzor inspected 135,000 tonnes of corn and barley at Astrakhan facilities for shipment to Iran, issuing 55 phytosanitary certificates after laboratory testing to comply with Iranian quarantine rules.

| Route | Commodity | Inspected Volume (tonnes) | Month | Certificates Issued |

|---|---|---|---|---|

| Astrakhan → Iran | Corn & barley | 135,000 | Jan 2026 | 55 |

The inspections confirm sustained use of the Russia–Iran grain corridor, with no immediate sign that Moscow’s longer-term export diversification strategy is curbing near-term corn and barley shipments.

Market Impact Assessment

EU meal markets: The contraction in German soybean and rapeseed meal exports is neutral to slightly bearish. It suggests softer crushing margins or feed demand and potentially greater availability of meal for domestic use, which could cap price rallies unless raw seed supplies tighten further.

Black Sea grains: Russia’s 2030 strategy is currently neutral for spot and nearby Black Sea pricing. While future reductions in grain’s export share could tighten exportable surpluses for wheat and corn, current data—including continued Iranian shipments—indicates robust near-term flows. Incremental growth in processed exports may gradually absorb more domestic grain, but a material impact on balances would require a much larger scale-up in flour and vegetable oil exports.

Source: Market Data

Leave a Reply