- Production Boost: IKAR raised Russian wheat export potential to 46.5 million tonnes on the back of a larger-than-expected 139.4 million tonne grain harvest, including 91.4 million tonnes of wheat.

- Logistics Constraint: A record-low 57% share of wheat from southern export hubs creates complex and potentially costly logistics that may cap actual exports near 44 million tonnes.

- Pricing Pressure: A strong ruble and weak dollar-denominated wheat prices are squeezing export margins, limiting Russia’s ability to fully realize its theoretical export potential.

- Market Impact: Neutral to bearish overall, as higher supply is offset by export bottlenecks, potentially supporting competing origins if Russia cannot move volumes efficiently.

Market Update

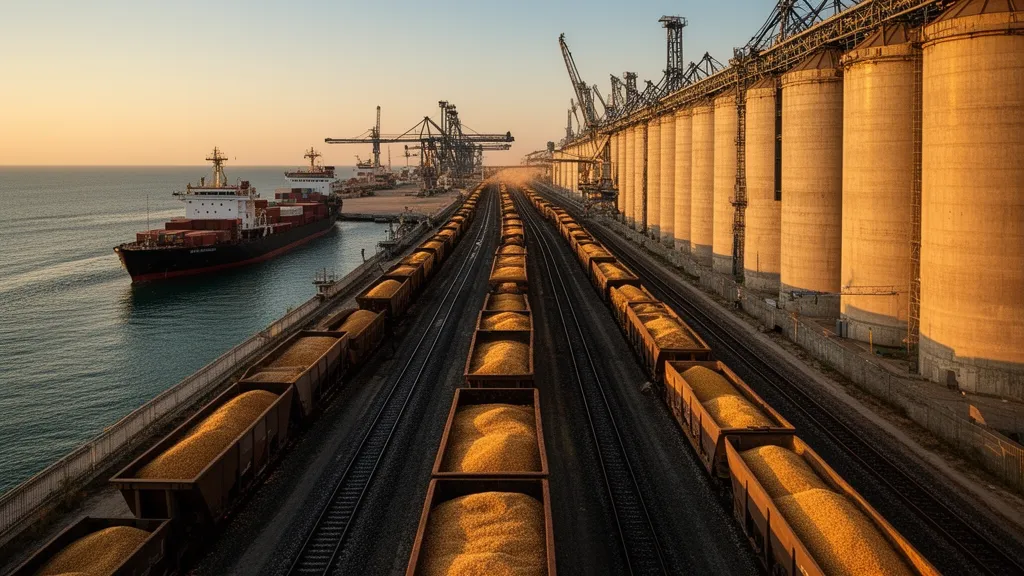

The Institute for Agricultural Market Studies (IKAR) has increased its estimate of Russian wheat export potential for the 2025/26 marketing year to 46.5 million tonnes, up from 44 million tonnes. Total grain export potential was raised to 60.2 million tonnes from 58 million tonnes, following stronger-than-expected harvest data from Rosstat showing a 139.4 million tonne grain crop, including 91.4 million tonnes of wheat.

IKAR CEO Dmitry Rylko stressed that these figures represent export capacity rather than a firm forecast of actual shipments. The southern region’s share of wheat production has fallen to a historic low of 57%, shifting more grain away from traditional Black Sea export hubs and complicating logistics. Combined with a strong ruble and low global dollar-denominated wheat prices, export economics remain challenging, and realized exports may stay closer to 44 million tonnes.

Harvest and Export Potential Overview

| Metric | Previous Estimate | Revised / Actual |

|---|---|---|

| Total Grain Harvest (million tonnes) | Below 139.4 (earlier forecasts) | 139.4 (preliminary Rosstat) |

| Wheat Harvest (million tonnes) | Below 91.4 (earlier forecasts) | 91.4 |

| Total Grain Export Potential (million tonnes) | 58.0 | 60.2 |

| Wheat Export Potential (million tonnes) | 44.0 | 46.5 |

| Likely Actual Wheat Exports (million tonnes) | 44.0 | Near 44.0 (IKAR indication) |

| Southern Region Share of Wheat Production | Above current level | 57% (historic low) |

Analysis and Trading Implications

The overall signal is neutral to bearish for global wheat markets. Higher Russian output and theoretical export capacity add to potential global supply, but structural bottlenecks limit how much of this grain can reach export channels efficiently. The reduced share of wheat from southern Russia forces longer and more complex transport routes, raising costs and delaying flows from inland regions to ports.

At the same time, a firm ruble and low international wheat prices are compressing margins for Russian exporters. Without a notable decline in regional wheat prices or a shift in currency dynamics, exporters may be unable to fully utilize the 46.5 million tonne export potential. This opens a window for competing origins to defend or gain market share, especially in price-sensitive destinations in North Africa, the Middle East, and Asia.

Traders should closely watch regional price spreads within Russia, freight and logistics costs out of non-southern regions, and ruble movements against the U.S. dollar. Any softening in the ruble or further drop in inland prices could unlock additional Russian export flows, while persistent constraints would limit downside pressure on global benchmarks and support alternative exporters.

Source: Market Data

Leave a Reply